Why Global Firms Need a Smarter Playbook for Japan

Mid-Career Hiring in Japan: Global Firms Need a Smarter Playbook To Compete

I’ve just returned to Japan after several years overseas, and the change is striking. The hiring landscape has become tougher on multiple fronts: a wave of new entrants in AI, data, security, and SaaS are all chasing the same bilingual talent, while Japanese tech ventures – well-funded and ambitious – are starting to pull strong candidates back from global vendors.

The result is a market where both domestic and foreign firms are struggling to compete. Let’s look at what the data tells us, and why global firms in particular need a smarter approach.

Japanese corporates confirm the squeeze

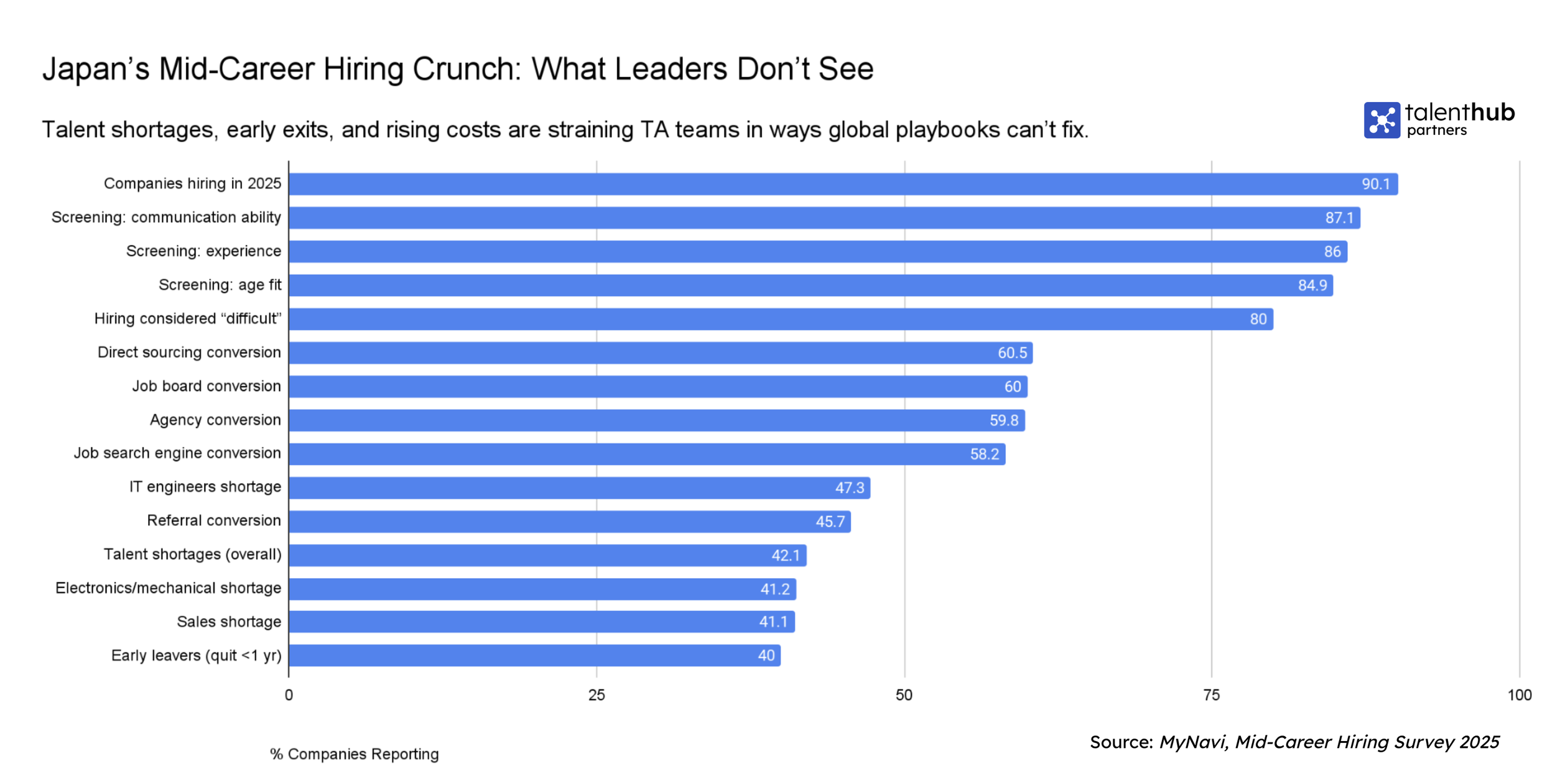

The MyNavi 2025 Mid-Career Hiring Survey (2024 actuals) shows the whole market is under stress:

42% of companies report talent shortages, with IT, electronics, and sales hardest hit.

80% say hiring is difficult, with costs averaging ¥6.5M per company.

40% experienced early quits (“やっぱり離職”), often due to mismatched roles, culture, or managers.

While this data reflects mainly domestic corporations, it’s still relevant: everyone is struggling. For global firms, the problem is magnified because bilingual GTM (Go-To-Market) candidates are scarcer and harder to win.

The gaishikei reality: sales and IT hardest hit

According to JETRO’s 2024 survey of foreign-affiliated companies, the hardest roles for global firms to hire are in GTM:

Sales & Marketing (60%)

Engineering/Technical (40%)

These numbers reflect what we’ve consistently seen across past projects and industry data: the very roles global vendors rely on for market growth are the toughest to fill.

Why candidates are moving – and what they want

The Hays Asia Salary Guide (2025) reports that 66% of professionals in Japan plan to change jobs this year – the highest in Asia. Mobility is high, but choice is candidate-driven.

At the same time, an en world × ACCJ study found that employees at foreign companies are more satisfied with work styles (53%) than at Japanese firms (42%). This dissatisfaction with domestic work culture is a major opening for global employers – if you position and communicate your brand effectively.

What this means for global firms

From my perspective, three lessons stand out:

Brand matters more than ever – Candidates weigh culture, flexibility, and leadership credibility. If your brand story isn’t clear, agencies default to pitching a job description. In the RPO model we’ve developed, controlled microsites and messaging frameworks are designed so every recruiter tells the same story.

Channel strategy is critical – MyNavi shows corporates lean heavily on job boards and aggregators. For gaishikei, these often underperform. JETRO’s findings highlight the real crunch is in sales and IT, where direct sourcing, referrals, and activated agencies deliver stronger results.

Retention is the hidden opportunity – MyNavi found early quits often stem from cultural or manager misfit. For foreign firms, this risk flips into an advantage: en world × ACCJ shows employees at foreign companies are more satisfied with work styles. That means global firms can both pull talent away from unhappy environments and keep their own people longer. Strong retention not only reduces hiring pressure, it also creates advocates inside your team who become powerful referral sources.

The takeaway

Japan’s mid-career hiring market is tightening for everyone, but global firms face sharper competition and higher risk. Talent shortages are real, costs are rising, candidates are more mobile, and dissatisfaction with Japanese work styles is fuelling both risk and opportunity. Firms that invest in branding, optimise their channels, and build cultures where good people stay will not only cut their reliance on constant backfilling but also unlock the strongest referral engine available: their own employees.

Where we fit in

After more than 20 years leading search firms and RPO in Japan, I’ve seen the limits of traditional recruitment models. Most providers simply add recruiter headcount without solving the deeper issues of brand, channels, and retention. That’s where we’re different.

Together with my business partner, I’ve spent the past few years building an AI-powered recruitment platform designed specifically to tackle Japan’s hardest hiring challenges. Technology isn’t an add-on for us – it’s the foundation. It drives brand consistency across agencies, job boards, and LinkedIn, while also powering proactive referral mapping that surfaces hidden talent. Once deployed, experienced recruiters can operate on top of the platform, ensuring the tech translates into measurable results.

As we launch in Japan, our goal is clear: to help global firms compete more effectively in one of the toughest markets in the world, with solutions that go beyond admin-heavy RPO and deliver real hiring impact.

A quick intro video about this post

I thought I would test using video for the introduction. Let me know if this is useful!

Sources:

Disclaimer: AI was used to review and summarise research. Please confirm data directly with the source reports.